Understanding Your Coverage to Protect Your Organization: Real-World Examples

We all know that insurance is a product we pay for in the hopes that you will never have to use it. That goes for everything from car insurance to travel insurance. For international NGOs with employees across the globe, often in unstable regions, it’s even more critical to have the right coverage in place — and you hope even harder that you never have to use it.

A few weeks ago, we detailed several case studies that showed how understanding your coverage can uncover value. Review that article if you want to familiarize yourself with some basic concepts about insurance and assistance. Today, we are diving deeper into ways to unlock value for your employees and your organization by understanding your coverage and other options — especially in volatile regions and emergencies.

Assistance without insurance

Understanding how insurance and assistance work together for the scenarios we are about to cover is essential. When you have an assistance plan without insurance, your organization would be financially responsible for any services the assistance vendor provides. If, for example, an employee gets sick and needs a medical evaluation, your assistance provider will ensure the employees get what they need — but your organization will have to pay the bill.

When you have insurance without an assistance plan, you will rely solely on the insurance company and any embedded partners they may have. You will not have direct access to the assistance vendor and may not have options to “buy up” additional features or coverage, such as travel tracking. You have financial protection but not all the tools you may need to provide your traveling employees with the best protection and assistance.

Now, let’s dive into two scenarios that illustrate ways to find value when you need additional coverage.

The intricacies of war risk coverage

War Risk Coverage is additional insurance that will cover your employees if they are injured or killed during a war or terror-related event. This can include medical coverage, but it will also most likely include death benefit coverage. Understanding the terms, conditions, and limitations of any war risk-related coverage in your policies is critical.

War risk coverage is a concern for many INGOs. Whether you operate full-time in an area where military action is underway or simply provide services during a time of war, it’s essential to understand whether you have war risk coverage and, if not, the most efficient way to get coverage for your employees. Finding the best solution for war risk coverage can be complicated as it varies significantly from one carrier to the next.

Because these plans also cover terror events—which are hard to plan for—understanding what is covered is imperative to readiness. Medical-related claims are often covered in the event of a terror attack because they tend to be smaller and present less of a catastrophic risk to the insurance carrier. However, it is more common for an insurance carrier to restrict or exclude Life and Disability claims due to war and terror because of the catastrophic risk this presents to the insurance carrier.

Let us explore an example. If an insurance company covers 100 employees in one work location for a life benefit of $100,000 and that location is hit with a terror attack and 55 people are killed, the insurance company's risk would be catastrophic, with claims totaling $5.5 million. Insurance companies are very concerned about the concentration of risks and, therefore, will implement protections like "exclusions for war risk" or "limitations."

In another example, one of our clients was awarded a contract in Ukraine, making war risk coverage an absolute must. However, their current policy does not already include it. Adding it to their Business Travel Accident (BTA) insurance would cost another $35,000, bringing their total spend to $136,000. However, that’s not the only option.

We realized that the organization could change plans at renewals and instead get war risk covered under a Medical Business Travel (MBT) plan for $32,000. Even with the assistance vendor’s costs added in, the total came to $103,000, realizing a savings of 24% for this client. This example illustrates how important it is to understand how different providers approach the same type of coverage and how having an expert on your side can help your organization realize significant savings.

Understanding product connections

The devil is in the details, right? That’s why it is so important to look at the fine print, which can be onerous in the case of insurance and assistance policies. However, when you do not take the time to understand how these products work together and read the “fine print” of your coverage, it could end up costing your organization dearly.

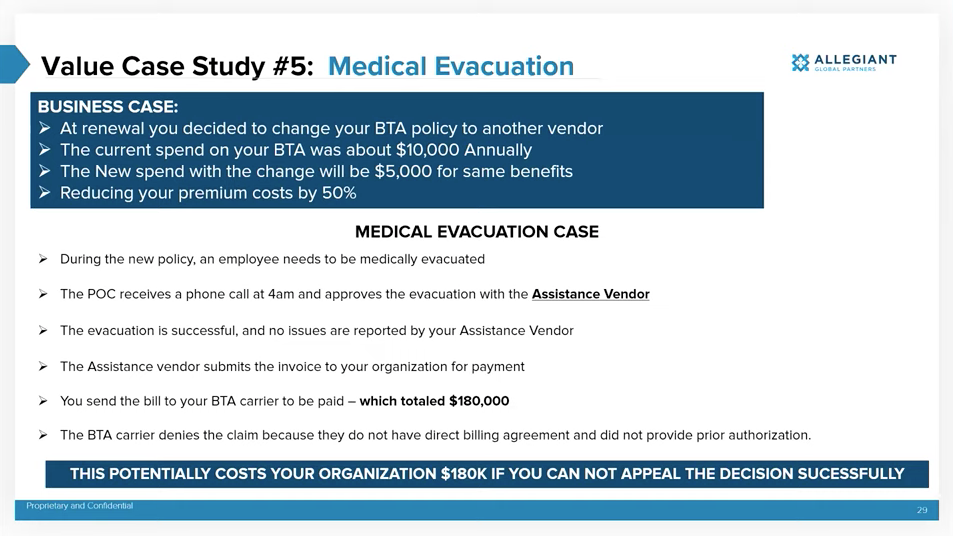

Recently, an organization decided to change BTA vendors to save $5,000. However, they did not realize that their insurance company required prior authorization for medical evacuations and did not have a direct billing agreement with the assistance vendor. So, when an employee fell ill and needed a medical evacuation — authorized by the organization’s point of contact (not the insurance company) — the client was faced with a bill of $180,000.

In this case, the client had all the right assets in place; they needed to learn how the products worked together and what steps were needed to ensure coverage for a costly claim.

What is a direct billing agreement?

A direct billing agreement is an arrangement between two vendors. For our purposes, that is the insurance company and the assistance company. The two have rules of engagement and interaction, making it more seamless for the members and the employer. The agreement eliminates the need for the employer to either front money or seek approval from their insurance company before moving forward. Essentially, it allows for direct communication between companies.

How do you avoid expensive mistakes?

Medical evacuations are expensive. The examples above show that just one can cost more than an organization’s insurance and assistance policies. The truth is, when you are dealing with various employee types in many countries, it is easy to miss something and not realize when your coverage is lacking or what steps need to be taken to ensure an emergency is covered.

At Allegiant, we have an internal audit exercise that uses hypothetical situations to anticipate different scenarios. We run through the same scenarios for various employee types, and this is something we can help you do internally. A little diligence will safeguard you from unintentional consequences that could be financially disastrous for an organization. To learno more about our approach, feel free to reach out via the button below.

Watch the full webinar from which these case studies came for more insight. Please note that the SHRM credits we offered in association with this webinar were only available for live attendees.